When you’re ready to find a mortgage lender so you can buy your home, you might already know that your credit score will help determine whether you can get approved for a loan. This number tells lenders how much risk they’ll take on when they give you a loan, and how likely you are to keep up on your payments. Nowadays, it’s relatively easy to keep track of this three-digit number.

How Does Your Credit Score Work?

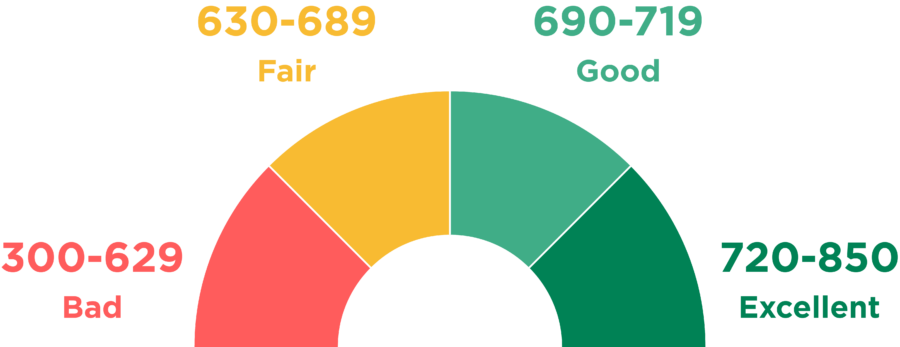

Your credit score is a three-digit number that sums up your credit report. Credit bureaus use two different models: FICO and Vantage Score, to calculate your number. Your number can range from 300 (poor) to 850 (excellent.)

Both scoring models use the following information to calculate your score:

-Your credit report’s age. The older, the better.

-Your payment history. Late payments tend to lower your score, while making payments on time will have the opposite effect.

-What percent of your available credit you’re utilizing. The lower this number is, the better. Using, say, 80% of your available credit will hurt your score.

-How many different types of credit you have. Having a loan and a credit card, for example, will help your score.

-How often creditors have made inquiries into your score. If this happens too often, this can hurt your score.

Each category adds a different number of points to your score.

What Does Your Score Say About You?

Lenders look at your score to determine how likely you are to go 90 days past due on an account within two years. The higher your score, the less likely you are to default. The lower your score, the riskier you become. Lenders also use this information to determine your interest rates and credit limits.

While “good” scores vary from lender to lender, a good benchmark to aim for is a score of 720 when seeking the best rates for automobile loans, and a score of at least 760 when seeking the best rates for mortgage loans.

Be sure to contact us with any questions related to real estate and mortgage loans. We’re here to help and serve the North Alabama area.